Life Insurance*

Help protect your family, starting today.

TruStage® Life Insurance could be a simple, affordable way to help protect your family. It's money your loved ones could use to help pay mortgage or rent, day-to-day bills, medical and funeral expenses–whatever is needed most.

TruStage® can help you get coverage that fits your needs and budget. We designed it to be easy to:

- Compare life insurance options

- See instant quotes based on your budget

- Apply online or over the phone

Don’t wait. Get an instant online quote today. Or call 1.800.814.2914 and talk to a licensed agent.

Help protect your family, starting today.

TruStage® Life Insurance could be a simple, affordable way to help protect your family. It's money your loved ones could use to help pay mortgage or rent, day-to-day bills, medical and funeral expenses–whatever is needed most.

TruStage® can help you get coverage that fits your needs and budget. We designed it to be easy to:

- Compare life insurance options

- See instant quotes based on your budget

- Apply online or over the phone

Don’t wait. Get an instant online quote today. Or call 1.800.814.2914 and talk to a licensed agent.

Accidental Death & Dismemberment Insurance**

Accidents can happen anytime

That’s why you’re entitled to $2,000 of no-cost TruStage® Accidental Death & Dismemberment Insurance—an exclusive member benefit fully paid for by Rogue Credit Union.

You can enroll in your no-cost coverage in just a few minutes. If you choose, additional insurance is available for you or your entire family designed to be at budget-friendly rates. Your acceptance is guaranteed—with no health questions or medical exam.

Since accidents can happen anytime, there’s no better time to help protect the people who matter most.

Auto & Home Insurance†

Designed for credit union members like you, the TruStage® Auto & Home Insurance Program provides affordable top-quality protection. You could enjoy discounted rates combined with online convenience and 24/7 claims service.

Get your free quote online today or call 1.855.589.2146.

GAP Insurance

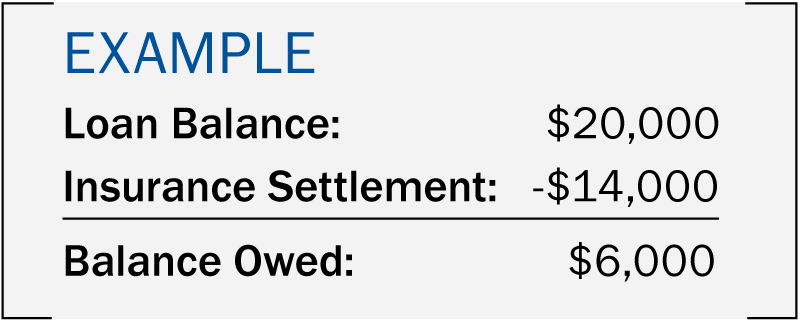

Rogue Credit Union knows that when you purchase your vehicle you never anticipate getting in an accident or having your vehicle stolen, but unfortunately these situations do happen. GAP Insurance helps pay the difference between the member’s insurance settlement and the outstanding loan balance (the “gap”), if the protected vehicle is stolen and not recovered, damaged beyond repair, or otherwise declared as a total loss. It is not uncommon to have an outstanding loan balance that exceeds the vehicle’s book value. GAP Insurance protects members by paying the insurance deductible and by paying off the balance on the loan after the insurance settlement.

Rogue Credit Union members have the opportunity to purchase GAP insurance at a very affordable price. Compare the costs and make sure you protect yourself by applying GAP insurance to your new loan.

GAP Insurance FAQ

What causes the gap in insurance coverage?

When can I purchase GAP Insurance through Rogue Credit Union?

Who is eligible for GAP Insurance Coverage?

When does coverage terminate?

Can I cancel my GAP coverage?

How do I file a claim?

What is the time frame for submitting a claim?

Debt Protection††

Protect the things that matter most.

If your life takes an unexpected turn, your family’s finances can be strained. But with Debt Protection, your loan payments or balance may be canceled, up to the contract maximums, in case of involuntary unemployment, disability, or death. It’s just one more way you can look out for the people you love.

- Involuntary unemployment - a covered job loss occurs

- Disability - a covered disability occurs due to illness or injury

- Death - protected borrower passes away

- Terminal Illness - a covered illness occurs

- Hospitalization - a covered hospital stay occurs

Take an important step toward financial security. Ask Rogue Credit Union about Debt Protection today.

Credit Life & Credit Disability FAQ

I have sick leave through my employer, will that cover my expenses?

Will my workers comp or employee disability insurance cover me during this time? Do I need the additional credit insurance for my loan?

What about my other life insurance coverage, is that enough?

We have two incomes. Will that be sufficient?

I am a healthy person, do I need insurance?

How do I know if I can afford this loan insurance?

How does enrollment work?

*TruStage® Life Insurance is made available through TruStage® Insurance Agency, LLC and issued by CMFG Life Insurance Company. The insurance offered is not a deposit, and is not federally insured, sold or guaranteed by your credit union. Product and features may vary and not be available in all states. TruStage® is underwritten by CMFG Life Insurance Company, a well-known credit union member insurance provider for more than 80 years. CMFG Life has earned the trust of members nationwide and is rated “A” (Excellent) by A.M. Best, an independent national organization that rates insurers’ financial strength and performance. “A” is the third-highest of 16 ratings, as of March 2021. Join more than 20 million members who rely on TruStage®.

**TruStage® Accidental Death & Dismemberment Insurance is made available through TruStage® Insurance Agency, LLC and issued by CMFG Life Insurance Company, PO Box 61, Waverly, IA 50677‑0061. The insurance offered is not a deposit, and is not federally insured, sold or guaranteed by your credit union. Products and features may vary by state. Base Policy Series E10a-015-2012, E10a-014-2012, E10a-ADD-2012 and 2018-ADD-POL

†TruStage® Auto & Home Insurance Program is made available through TruStage® Insurance Agency, LLC and issued by leading insurance companies. To the extent permitted by law, applicants are individually underwritten; not all applicants may qualify. Discounts are not available in all states and discounts vary by state. A consumer report from a consumer reporting agency and/or motor vehicle report will be obtained on all drivers listed on your policy where state laws and regulations allow. Please consult your policy for specific coverage and limitations. The insurance offered is not a deposit, and is not federally insured, sold or guaranteed by your credit union.

††Your purchase of Debt Protection Life Plus, Life Plus and Disability or Life Plus, Disability and Involuntary Unemployment is optional and will not affect your application for credit or the terms of any credit agreement required to obtain a loan. Certain eligibility requirements, conditions and exclusions may apply.

Please contact your loan representative or refer to the Member Agreement for a full explanation of the terms of Debt Protection Life Plus, Life Plus and Disability or Life Plus, Disability and Involuntary Unemployment. You may cancel the protection at any time. If you cancel protection within 30 days, you will receive a full refund of any fee paid.