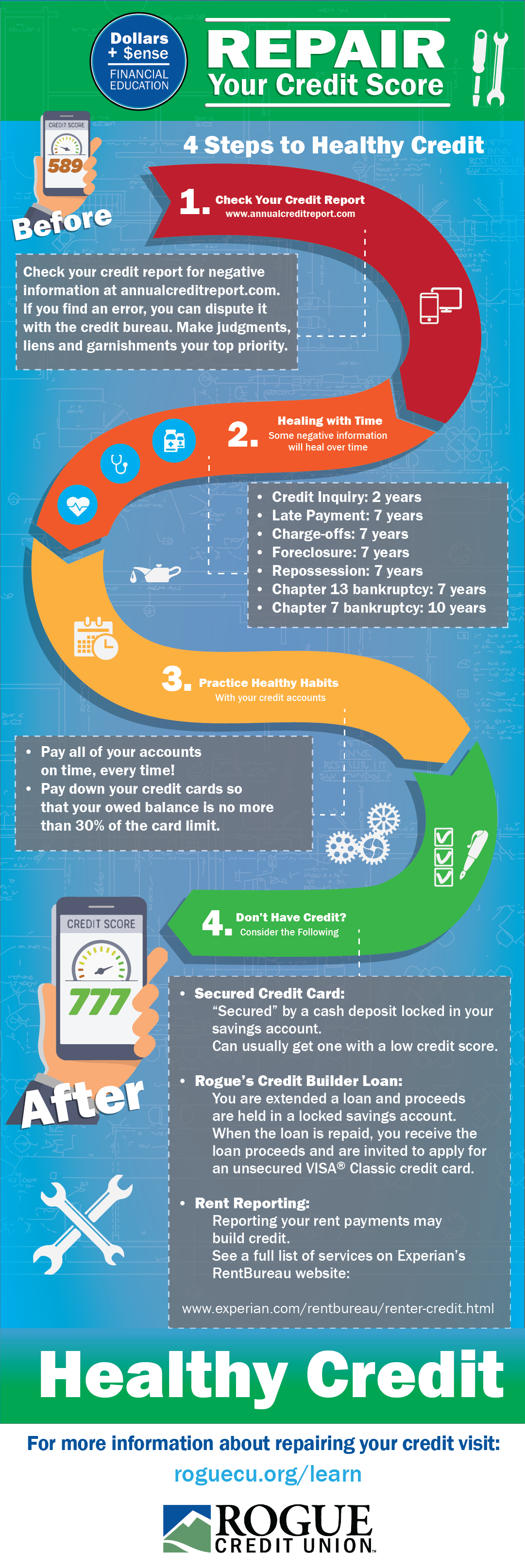

How to Repair Your Credit

Steps to Repair Your Credit Score

- Check your credit report for negative information at www.annualcreditreport.com . Make judgments, liens and garnishments your top priority.

- Some negative information on your credit report can only heal with time:

- Credit Inquiry: 2 years

- Late Payment: 7 years

- Charge-offs: 7 years

- Foreclosure: 7 years

- Repossession: 7 years

- Chapter 13 bankruptcy: 7 years

- Chapter 7 bankruptcy: 10 years

- Practice healthy credit habits on your current accounts if you have any.

- Pay all of your accounts on time, every time!

- Pay down your credit cards so that your owed balance is no more than 30% of the card limit.

- If you don’t have a credit account, consider the following tools:

- Secured Credit Card:

- “Secured” by a cash deposit locked in your savings account.

- Can usually get with a low credit score.

- Rogue’s Credit Builder Loan:

- You are extended a loan, proceeds are held in a locked savings account.

- When loan is repaid, you receive the loan proceeds and are invited to apply for an unsecured Visa Classic.

- Rent Reporting:

- Report your rent payments to possibly help build credit.

- See a full list of services on Experian’s RentBureau website, www.experian.com/rentbureau/renter-credit.html.