Budgeting Methods

Budgeting after the holidays is not only the financially sound thing to do, it is essential. Remember, budgeting is not just for those who are in debt, it is for everyone! Last month we learned about setting SMART goals, and this month we will explore a few methods you can utilize as you save towards your next vacation, your retirement or even your next home!

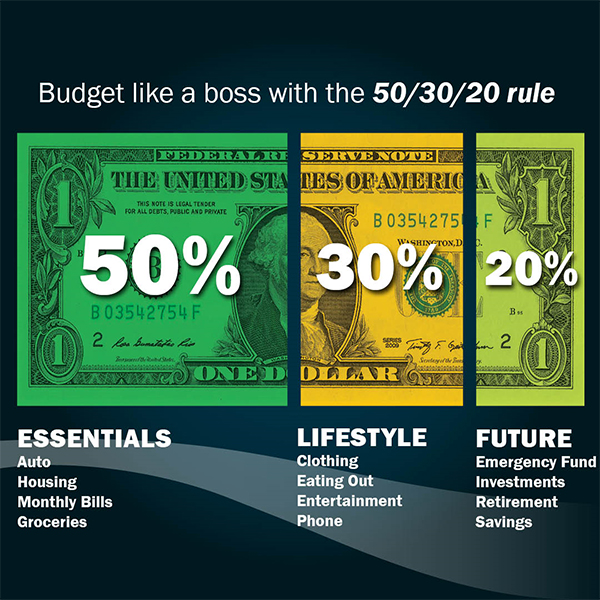

The Percentage Budget, also known as the Proportional Budgeting Method, gives you a loose spending strategy which you can use one of two ways. It gives you the ability to pay down debt, cover current costs and save for future expenses. Your first option is to split your income across three major categories: 50% to necessities, 30% to wants and 20% to savings and debt repayment. Or, a second method is the spending versus saving option. The 80/20 budget is a percentage budget where you put 80% of your income towards expenses (both wants and needs) and save 20%. You don’t need to track which expenses go where, as long as you’re staying within that 80%.

If you are looking for something a little more rigid to curve spending and are not wanting to track every purchase, look into the Envelope Method; otherwise known as the Cash-Only Budget. By setting amounts per category (such as groceries, dining, gas, entertainment, etc.) you only have certain amounts in each envelope which must last the entire month. This strategy is great for bringing awareness to your spending and ensuring that you can’t spend more than you have, which can be easy with credit or debit cards.

Paying Yourself First is another method you can use. This “reverse” budget puts savings and other emergency funds before immediate expenses. You decide how much you want to save each month, then allocate other income to essential bills after that. This is not a number crunching game, but not all individuals have the freedom to put savings before the cost of living. The formula for this method goes like this;

Monthly income – regular monthly expenses = what you can send to your savings.

A good rule of thumb to follow for how much you should be saving is to aim for at least 5-20% of your income.

After analyzing your spending habits, are you finding that you are overspending, or do you simply love meticulously planning your budget? If so, the Zero-Based Budget might be the best bet for you. This method looks at being deliberate in both spending and saving and leaving no money unspent! The thought behind this is to tackle spending your unaccounted for money, and being aware of and in control of where it goes. Each month, you start with a certain amount but always end with zero.

Let these four budgeting methods be a starting place for your financial wellness. Don’t let budgeting intimidate you, but let it empower you. Remember, becoming aware of your spending habits is one of the first things to consider when looking at your budget. Asking yourself questions before starting the process is imperative. Are you making less than what you are spending? What unnecessary spending habits can you cut out if you answer yes to this question? What are you saving for and what is the realistic time frame for you to meet that goal? Find out how much you need to save each month in order to be successful. Rogue Credit Union offers several calculators to make this easy!

One way to approach the task of budgeting is to find out what works best for you. Or, sometimes, what does not work for you. Make sure to give yourself grace, flexibility, and the ability to try new methods. Figure out what amount of tracking and effort you want to put into your budgeting method and most importantly, be aware and accountable. Some people like printing out a budget sheet and filling it in manually monthly, daily, or even after every transaction. Others may like an Excel spreadsheet on the computer, or even keeping receipts. You can also use free apps such as Dave Ramsey’s Every Dollar. However, our Rogue members have the ability to integrate their Online or Mobile Banking in one spot! Rogue’s Money Management tool is here to help you generate a budget and create a personal spending analysis. This system is a simple and intuitive way to access a complete overview of your financial health (including other financial institution and investment accounts, mortgage, loan accounts, credit cards, and more). Stop by your local branch or visit www.roguecu.org/learn for more information.